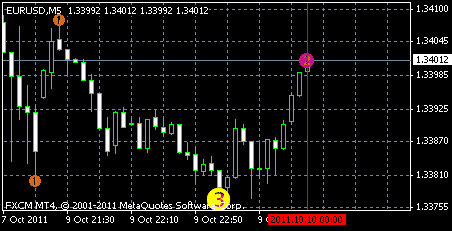

Spotting the next FX Swing

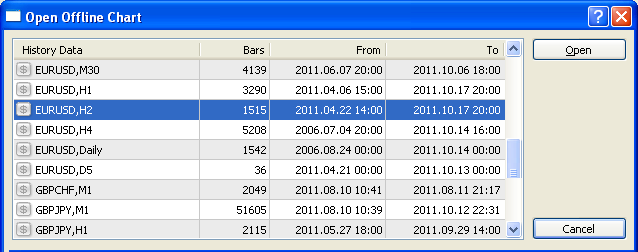

When trading in FX, scouting for just the right currency pair can be time consuming. Of course, you’re looking for the pair on the verge of producing the next lucrative trade. Many times it’s hard to decide which pair is the one with the most momentum. And even if you do invest all your time […]