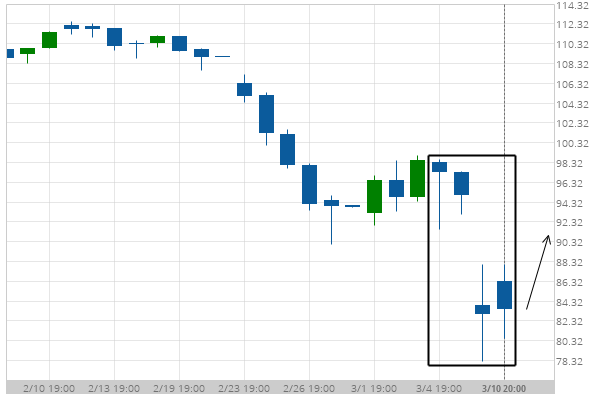

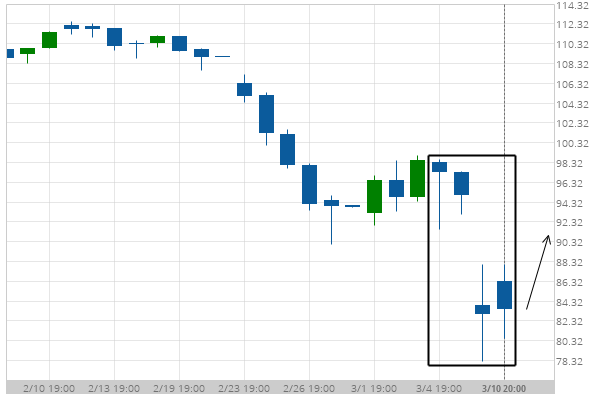

Chevron (CVX) excessive bearish movement

Chevron experienced 4 consecutive bearish candles. Possible bullish price movement to follow.

Chevron experienced 4 consecutive bearish candles. Possible bullish price movement to follow.