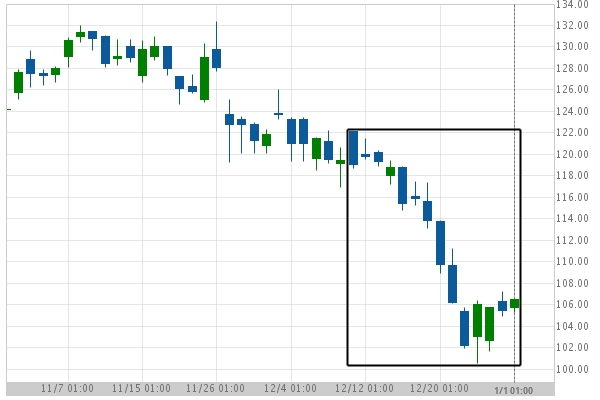

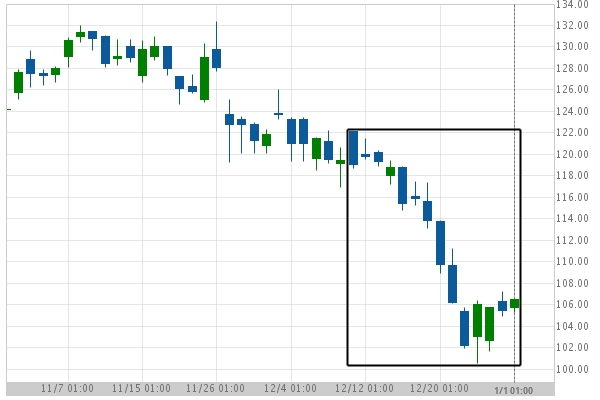

United Technologies Corp. (UTX) excessive bearish movement

United Technologies Corp. experienced a 12.8% bearish movement in the last 21 days.

United Technologies Corp. experienced a 12.8% bearish movement in the last 21 days.