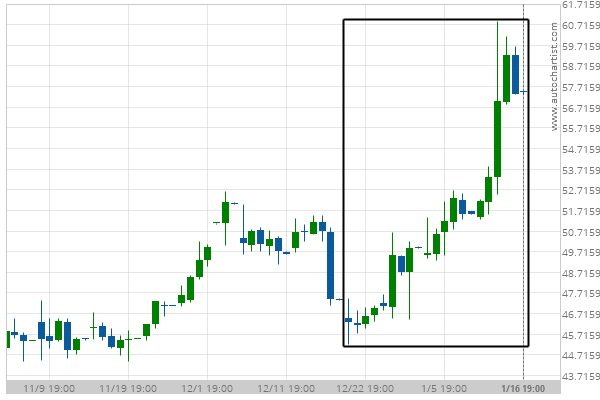

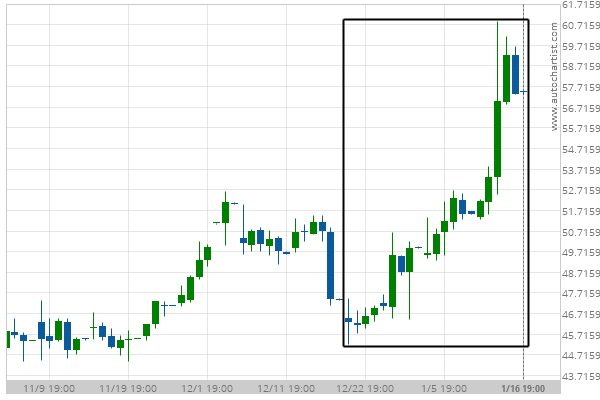

Intel Corporation (INTC) excessive bearish movement

Intel Corporation experienced a 24.44% bullish movement in the last 27 days.

Intel Corporation experienced a 24.44% bullish movement in the last 27 days.