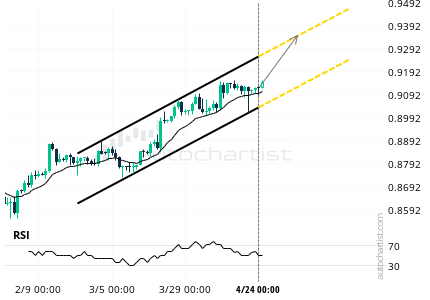

The USDCHF has experienced a bullish breakout through the upper limit of its upward channel, indicating a strong upward trend. The target is set at 0.935.

The trading scenario was spotted on the USDCHF pair. The USDCHF price has pierced through the resistance line of an upward channel pattern on April 24, 2024, at midnight. It is predicted that there could be a bullish price movement over the next 12 days towards 0.935.

The pattern’s overall visual presentation is of medium quality. The trading scenario is well-defined, with minor noise during price fluctuations between support and resistance levels. The breakout through resistance was somewhat weak, suggesting that waiting for further confirmation of this breakout might be prudent before initiating a trade.

It’s important to note that the USDCHF price could experience high volatility during economic events that occur within the forecast period. Specifically, the following events have historically caused significant fluctuations in the USDCHF’s volatility:

– United States GDP Growth Rate QoQ Adv on April 25 at 12:30 (UTC)

– Japan BoJ Interest Rate Decision on April 26 at 03:00 (UTC)

– United States Fed Interest Rate Decision on May 01 at 18:00 (UTC).