Two way profit with Carry Trade

The forex carry trade is a type of strategy in which traders sell currencies of countries with relatively low interest rates, and use the proceeds to buy currencies of countries that yield higher interest rates.

Forex carry trading leverages the differences in interest rates between countries. For example, one country’s central bank may lower interest rates in order to create economic stimulation, while the central bank in another country maintains higher interest rates.

In effect, the forex trader borrows money in one country with a lower interest rate, and invests it in another country with a higher interest rate, and keeps the difference in yield as profit.

A positive-carry forex trade (or simply “carry trade”) means that the position has a positive spread between the interest rates of the currencies. The carry trade strategy can capture this spread, and the profits depend on the leverage applied through the mechanical trading system.

Unlike more-complex strategies, forex carry trading is simple and effective. When market conditions are right, I enjoy good success with forex carry trading using mechanical strategies based on daily time frames.

What is “carry trading”?

Each forex transaction involves buying one currency, and selling another currency to finance that purchase. The “carry” of a currency or any other asset is the opportunity cost of holding that asset.

For example, the carry of a gold ingot is the cost of storing it in a secure warehouse. The carry of a $100 bank deposit is the interest received on the account, while the carry of a $100 bill in cash is the loss from inflation during the holding period.

Regarding the carry of forex pairs, the gain or loss is determined by the interest-rate differentials between the subject currencies.

For nearly two decades, the low borrowing cost of the Japanese Yen has been offering opportunities to savvy traders in stock markets as well as commodity markets. For example, some carry-traders have been buying Chinese or U.S. equities while shorting the Yen.

How does forex carry trading work?

In order to profit, forex traders must generally be correct about the direction of price movement. If a currency pair is interest-rate neutral, or if the carrying cost of the purchased and sold currencies balance out, then the only way to profit is by the currency pair’s price movement.

Yet, carry trading offers forex traders an extra dimension of profitability. When the carry is positive, the forex position can accrue positive income even while market fluctuations cause a short-term loss in currency value.

For example, in buying one lot of EUR/USD, the trader is buying one lot of Euros, and selling one lot of Dollars. By maintaining the position overnight, the trader pays interest on that currency which was sold, and he or she receives interest for the currency which was purchased.

So, in this example, if the interest received from the purchased Euros is greater than the interest paid for the sold Dollars, the trading account gains simply by holding the position.

The longer the winning position is held, the greater the possible interest income and the thicker the cushion against fluctuations in the market.

A forex carry trade creates an extra opportunity for profit as well as a layer of additional protection. And, the carry trade can also increase the potential longevity of a holding.

Part of the appeal of forex carry trading is the possibility of earning interest. Typically, income accrues daily for long carries with triple rollovers. Here’s the calculation to approximate daily yield:

[(Interest Rate of the Long Currency) – (Interest Rate of the Short Currency) / 365] x Notional value of the positionSo, for example, for one lot of NZD/JPY with a notional value of 100,000 the interest can be calculated like this:

[(0.0333 – 0.0033)/365] x 100,000 = about $8 per dayThis amount will be approximate, since banks use overnight rates which fluctuate daily. As well as yield for forex traders who are long NZD/JPY, traders whose strategies involve “fading” the carry, or else going short NZD/JPY can also earn interest.

How to prepare for forex carry trading

The first step toward a forex carry trade is to check the relative yields between forex pairs to discover which pairs offer the highest yields, and which offer lower yields.

Some of the most profitable carry trades involve forex pairs such as the New Zealand Dollar/Japanese Yen and Australian Dollar/Japanese Yen because their interest-rate spreads are often high.

In mid-June 2014, the benchmark LIBOR interest rates regarding the top currencies for forex trading were:

U.S. (USD) 0.54%

Australian Dollar (AUD) 3.35%

New Zealand (NZD) 3.33%

Swiss Franc (CHF) 0.18%

Japanese Yen (JPY) 0.33%

Eurozone (EUR) 0.46%

Canada (CAD) 1.78%

U.K. (GBP) 1.03%

Based on the interest rate inputs and price data feeds, the mechanical trading system mixes and matches forex pairs with the lowest and highest yields.

Since Australia and New Zealand usually have the highest yields while Japan and Switzerland have the lowest yields, they often provide good trading opportunities. Under the current circumstances, a likely forex carry trade is to buy AUD/JPY or NZD/JPY.

When does forex carry trading work best?

Forex carry trades work best when countries’ central banks are increasing their interest rates, or have announced plans to do so.

Although small, independent forex traders are often focused on gains from capital appreciation, large institutional investors usually seek gains from yield as well. For traders, the key is to enter the forex carry trade as near the beginning of the interest rate-increase cycle as possible.

When a country’s central bank raises interest rates, large investors often borrow money denominated in that country’s currency and open carry trades in the forex markets. This pushes the currency price even higher.

Forex carry trades also work well when marketplace volatility is low, because investors and traders are willing to accept more risk. Large traders are happy to receive the yield, even if the currency price doesn’t move. In effect, as long as the price doesn’t drop, forex carry traders can earn money simply by waiting.

When does forex carry trading fail?

Forex carry trades can work well, yet they’re vulnerable to both overall volatility and specific shocks. Interest-rate shocks and changes in economic policies may adversely impact any low-yield or negative-carry currency pairs.

And, they can cause catastrophes for high-yield, high-risk positions, especially in the JPY currency pairs, and sometimes in CHF pairs, too. Forex traders occasionally take risky short positions against Japan’s current account surpluses and it’s predictable external financing needs.

When a central bank changes its monetary policy, the value of its currency tends to respond quickly. If a country’s central bank begins to reduce interest rates, the carry trades in its currency become less profitable and more risky. For successful carry trading, the value of the currency pair must either stay the same or rise.

If a country’s interest rates fall, foreign investors lose interest in going “long” the related currency pairs. When this happens, foreign demand for the country’s currency pairs weakens, and the price usually drops.

Obviously, a forex carry trading strategy will fail if the currency exchange rate is devalued by any amount greater than the average annual yield spread of the subject currency pair. And, because of leverage, losses from a losing carry trade can quickly become overwhelming.

As well, forex carry trades can also fail if a country’s central bank intervenes in foreign exchange markets by buying or selling currency in order to keep prices from rising or falling.

For countries which depend on exports, an overly-strong currency can reduce the demand for those exports. And, countries with weak currencies may intervene in order to boost their currencies’ prices. In any event, even a rumor of intervention can end the profitability of forex carry trades.

Forex carry trade strategies

As an example of a basic forex carry trade strategy, a mechanical trading system might execute trades in AUD and USD pairs when the U.S. Federal Reserve “talks up” interest rates at the same time that the Australian central bankers end their own interest-rate tightening.

Carry trades involving JPY have been especially popular among forex traders. Fueled by perennially-low Japanese interest rates, many investors and traders borrow money there and invest it elsewhere at higher interest rates. The excess or spread between the two interest rates is the trader’s profit.

In the recent past, the low-lying Yen has been joined by a cheap Dollar, so anything priced in dollars has risen. Here’s a typical yen-carry trade: The trader borrows JY to fund the purchase of the higher-yielding currency.

So long as the currency exchange rate between Japan and the other country stays the same, the forex trader can gain as much as the difference between the two countries’ interest rates. Outsize gains can follow when high leverage is used in a winning trade.

Even if yield spreads appear small, the use of strong leverage can mean big gains. In the best trades, the profits come from both capital gains and positive yields.

Under ideal conditions, the interest-rate spread widens because the interest rate in one country remains the same while the rate in the other country moves in the desired direction for an extended period of time.

Of course, a winning forex carry trade strategy involves more than simply going “long” a currency with a high yield while going “short” a currency with a low yield. Although current interest rates are important, future interest rates are most important of all.

Many forex carry trades are executed by large institutional investors and held for periods of months or even years; these investors typically seek yield instead of capital gains. Yet, smaller traders can also profit from carry trading.

When the interest rate differential between a currency pair is significant, traders often find profitable opportunities by buying on dips in the same direction of the carry. This strategy is usually more profitable than trying to “fade” the carry.

Still, forex carry traders armed with good mechanical trading tools can profit by fading the differential in strong-weak pairs. The right algorithms can ensure that traders don’t remain in “short” positions so long that interest works against them.

For short-term traders, earning interest helps reduce the average cost of the trade, while paying interest increases the cost of the position. Although the currency-pair differentials aren’t significant intraday, during a three-to-five day trade they become much more important.

Risk management

Because of the leverage offered through forex carry trades, risk management is critically important for success.

Forex carry trades work best when markets are either complacent or optimistic. Central banks in various countries frequently take steps to increase or decrease their interest rates. Any hint of uncertainty about interest rates or overall economic conditions may cause investors to exit from carry trades.

Forex traders can help manage risks by choosing perhaps 3 each of the highest- and lowest-yielding currencies, instead of concentrating on only the single highest and lowest yields. That way, if one currency experiences a jolt that causes a loss, the other currencies may be somewhat insulated.

Through the magic of mechanical trading systems, portfolio allocations can be tailored based on interest rate curves and monetary policies from central banks.

Carry trading can carry you to success

For most traders, the returns from investments in assets with low interest rates are ho-hum. Yet, forex carry traders can take advantage of strong leverage to enjoy returns with both capital gains and interest yield.

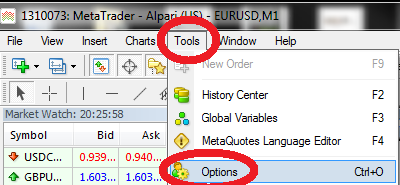

Forex traders who understand how to program mechanical trading systems for carry trading can profit even from relatively thin spreads. A well-crafted expert advisor (EA) can receive global interest rates and other fundamental inputs and can help implement a successful forex carry trade strategy.

Do you carry-trade regularly?