The Beginner’s Guide to Short Selling

Short selling is easy, right? Basically, it’s the same as buying, only going the other way. At least that seems to be the common belief when discussing shorts.

In practice, taking a short position is rather simple. However, it’s also utterly different when it comes to an actual strategy. Because, like it or not, shorts do mirror longs, absolutely and completely. And to be a really good short seller, you must know the difference. You must also know how to optimize your strategy specifically toward it.

Short Selling is Fear-based

When you short sell you gain when the instrument you’re trading moves lower. That’s the exact opposite of when you’re long, or a buyer. And that’s where the similarities between long buying and short selling end. You see, when a trader buys or goes long on something they’re betting the outlook for that instrument will brighten. And the instrument doesn’t matter, whether it’s a stock, or a commodity, or even an index like the S&P500.

As a side note, however, the case in forex is a bit different when there are currencies of the same status. For example, say the pair is comprised of the dollar and yen, which are both safe havens. But when it comes to say EUR/USD, EUR/JPY or GBP/USD, shorts on those pairs are still driven by fear.

But when traders sell? Now, notice the nuance, it’s not short sell, i.e. make money from a falling price, but actually selling. When a trader sells a position he or she is doing it out of fear of losing money. And it doesn’t matter if that selling is taking profit or trimming losses, it’s still driven by fear. When you’re short selling you’re basically trying to profit from the fear.

Fear, however, works differently than optimism. You see, fear tends to come and go quickly. You can liken it to a stampede of investors running from a predator.

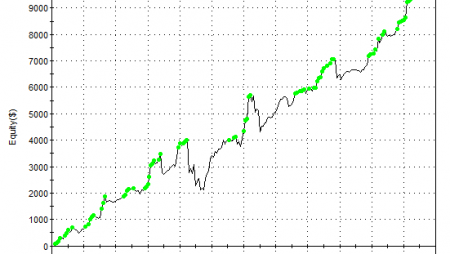

That’s not speculation; that’s fact backed by years of data. Take a look at some of the harsh short selling events in the chart below. You can clearly see that gains that took more than 8 months to achieve were wiped out in less than 4 months.

Why is that important to you as a short seller? Because it reveals the exact nature of shorts; quick and abrupt. As such, the strategies warranted for such movements should be designed accordingly. In other words, built to ride on quick and abrupt momentum for a quick gain and then closed. True, there are abrupt moves higher, as well, and matching momentum struggles. Momentum should be in the DNA of every short selling strategy if it is destined to succeed in the “long run.”

Starter Kit for the Short Seller

In order to be a successful investor you must be ready for a high momentum short time span trade. And of course, it’s all relative to the interval you trade. Here are some basic ideas and tools to help you get a sense of a solid short.

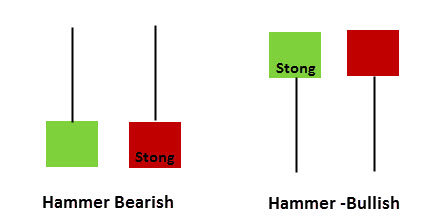

Trend exhaustion: When you have a prolonged bullish trend there comes a point when the trend hits a brick wall. The buyers just stop coming and the pair hits resistance. Soon after, those that already hold positions fear the trend is reversing. They quickly liquidate their position which results in a forceful short from the top.

There are countless methods to identify trend exhaustion but here is a rather simple one.

As you can see in the chart below, in this case a stock called Palo Alto, hit the top point of 200. But only when it fell back to 190 it stated to move rather quickly and abruptly down. What happened next was that the trend line was briefly broken. But there is another even more important element here and that is the MACD below. The histogram bars that preceded the correction when the trend was rising were rather moderate. In comparison, look at those created in the other direction when there was a short.

That clearly indicates that there is fear around 190 which triggered quick selling. A trend has to have at least two attempts before heading lower. Thus, it’s clear that another attempt will have to be made to break the 190.

Since we already know there is fear around this point we can expect a short. Once we reach the neck, the point where the selling started last time, that’s our entry point for a short. That, of course, will need to be closed quickly afterwards.

Overbought: Another basic strategy to capitalize on fear with a short is when a pair is overbought. Once again, there are numerous paths and methods to trade on this but here is a simple one. Looking at the EUR/USD as our example we will need to look for two things. When the pair closes above the price channel on the one hand and the RSI is at an overbought level on the other, the pair is overbought. That means an abrupt short is about to begin.